Importance of Japanese candlestick in Trading

Introduction of Japanese candlestick

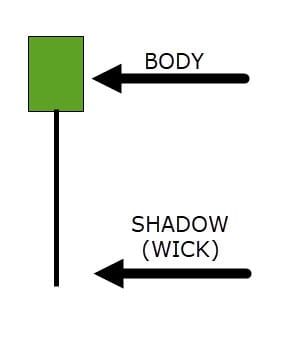

In today’s introduction chapter, we will learn about Japanese candlesticks. We can call Japanese candlesticks the ABCD of trading. They are like the structure of the human body; entering the market without fully understanding them is like going to battle without weapons. So, let’s understand them.

In the Western world, bar charts were used for trading for many years, but when Steve Nison met Japanese brokers during his visit to Japan, he learned about Japanese candlesticks. He found these candlesticks very simple and useful.

The first use of Japanese candlesticks was by a Japanese person named Munehisa Homma in the 17th century for rice trading. Since then, this technique has been used by the Japanese.

Benefits of Japanese candlestick

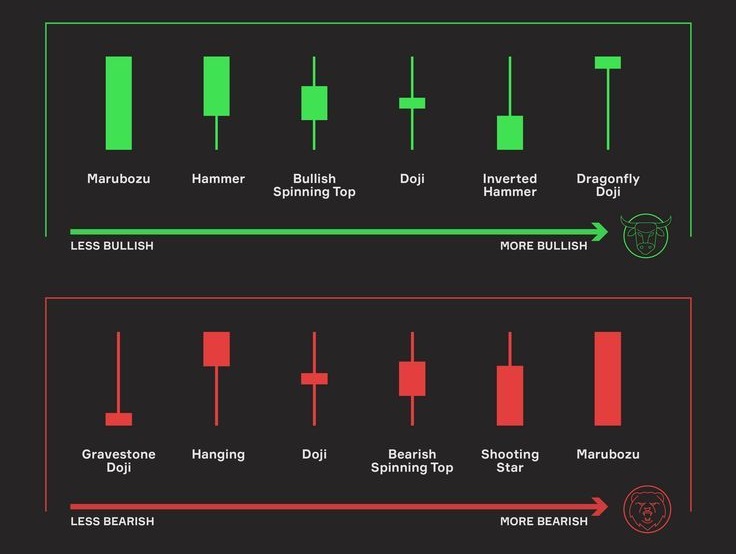

Although trading can be done using various techniques like bar charts, line charts, point and figure charts, area charts, etc., why use Japanese candlesticks? Let’s understand this. They can be understood very simply and, compared to other indicators, they quickly signal reversals, allowing traders to make timely entry and exit decisions. Candlestick patterns not only indicate trends but also the forces, i.e., the reasons initiating the trend. For example, the HAMMER candle, BULL and BEAR market

This technique has very unique and funny names that can be easily remembered, like cloud cover, hammer, gravestone doji, three black crows, three advancing white soldiers, etc. All these techniques can prove to be useful and effective weapons for traders in the market battle.

This pattern is so flexible that it can be easily combined with Western indicators. When combined with your favorite technical indicators like moving averages, trend lines, RSI, and Bollinger Bands, it becomes a powerful technical analysis tool and gives traders an upper edge.

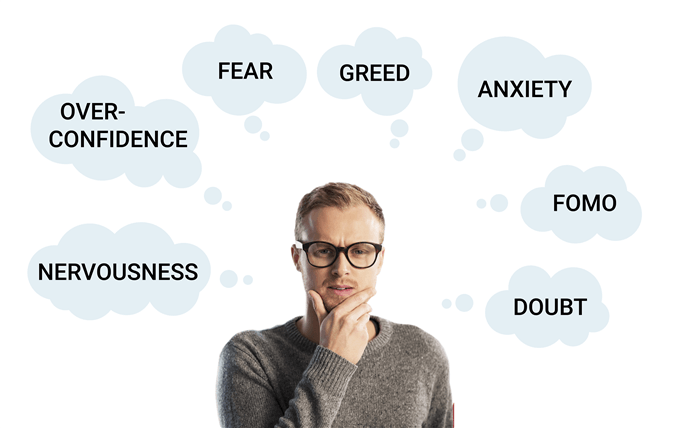

Japanese candlesticks can be used in any type of market where there is a glimpse of human emotion, as this pattern reflects human emotions in charts. Therefore, it is used in swing trading, day trading, futures and options, equities, foreign exchange, cryptocurrency, and any type of market.

Importance of Technical Analysis:

Let’s understand. If we compare technical analysis with fundamental analysis, fundamental analysis delves into the supply and demand of a stock, such as the price-earnings ratio, economic statistics, etc. There is no psychological component reflected in this; it is purely database-based. But the market reacts very quickly to any sudden event, such as election results, which are based on emotion.

To measure this emotion, we need technical analysis, and Japanese candlesticks are an effective tool for this. Therefore, any trader who spends time understanding the depths of Japanese candlestick patterns can become a long-term player in the trading world.

japanese candlestick pattern measure emotion

How does technical analysis measure emotion? Let’s understand with an example. In the U.S. city of Illinois, known as the hub of soybean farming, there was a severe drought, which caused soybean stock prices to rise significantly. If the drought continued, soybean stock prices would skyrocket. Suddenly, a few drops of rain were seen on the trading room window. Someone shouted, “Rain!”

Hearing this, all the traders became frantic with the sounds of “Buy! Sell! Buy! Sell!” filling the room. Shortly after, heavy rain began, and the soybean price, which was about to skyrocket, plummeted. In another city, Chicago, 300 miles from Illinois, the weather was clear and the sun was scorching. Interestingly, soybeans are not even grown there.

Yet, this rain affected the minds of people in Chicago, and that’s what matters in trading. Nothing in the market matters until it reacts. Simply put, it is a game of mind and emotion. Technical analysis helps us maintain disciplined trading and control our old enemy, emotions.

For example, when a trader suddenly gets money, they tend to ignore prudence and rules and trade based entirely on emotions, which is very harmful for trading. If someone wants to try this, they should do paper trading and see the difference. Trading with real money involves tension, fear, greed, etc., which are absent in paper trading.

From the example above, we can understand that trading is also a game of emotion and psychology, and Japanese candlesticks are very useful in identifying this emotion.